Transferly's Official Review of Placid Express

A comprehensive Placid Express review and breakdown of how to send money with Placid Express online including their Fees and Exchange Rates, Transfer Speed, Quality of Service, and more.

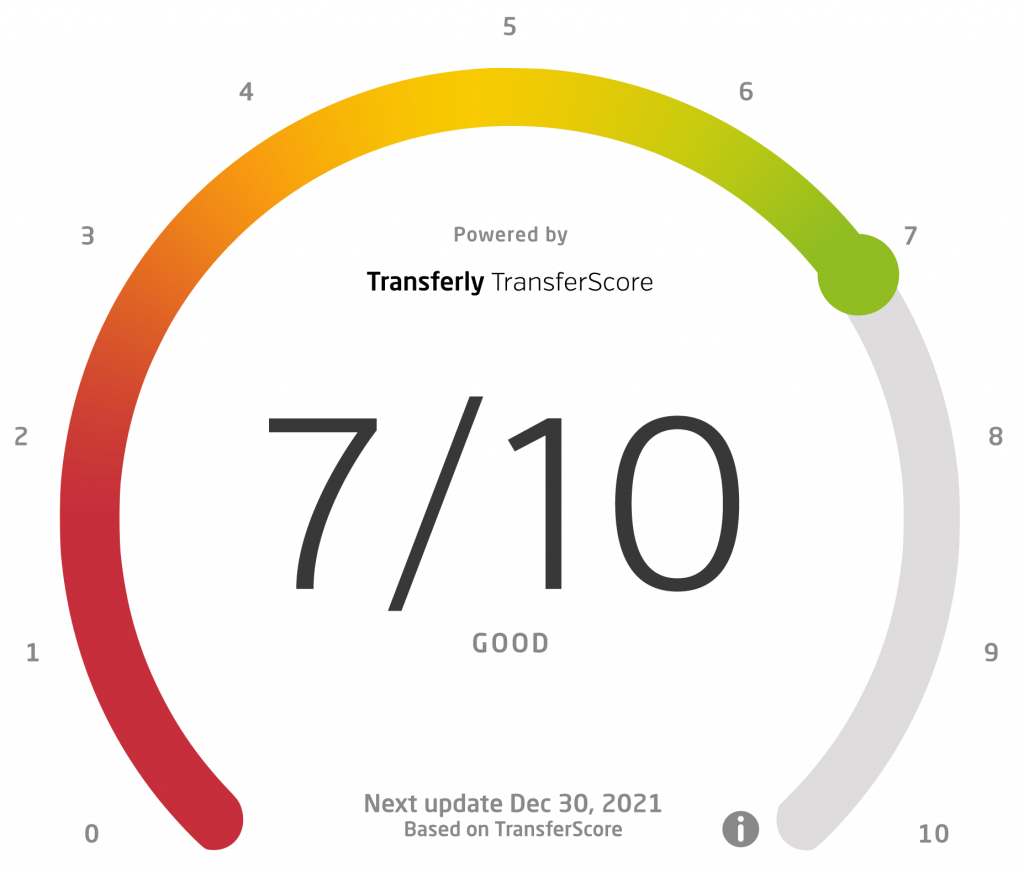

Placid Express Rating Breakdown

- Fast and simple money transfers to India and over 25 other countries

- Limited information and customer service assistance

BDT, EUR, IDR, INR, NPR, PHP, PKR, USD, VND

Pros

- Placid Express does not have any hidden fees. All applicable charges will be clearly presented to you before you confirm your transfer.

- The platform supports cash pickups through their spotCash! service, which is available in the majority of countries the service covers. Cash pickups at Placid Express are fast, secure, and quite convenient for many users.

- Placid Express transfers are direct and there are rarely any intermediaries involved.

- The service has good coverage, supporting money transfers to more than 25 Asian and European countries.

- Transfer speed at Placid Express is excellent — transfers funded by debit or credit card usually clear in less than an hour. Transactions paid through a bank account take from one to three business days to complete.

Cons

- Placid Express has some of the highest fees and most unfavorable exchange rates that we have seen on the market. While they vary between different payment methods, they are far from being the most cost-effective option out there.

- Some types of transfers need to go through a manual review before they are approved. As a result, some transactions might take longer than expected to complete.

- While the coverage is good, it is not the best one on the market. In order to use Placid Express, you need to reside in one of the 25 supported countries. Also, if you are from the USA, you get a limited range of countries to which you can send money to.

- Transfer limits at Placid Express are a bit restrictive. If you want to send large amounts of money regularly, you might want to look into alternative platforms.

- Fees and exchange rates at local agents are not available online. You need to go and talk to a representative on-site in order to get this information.

Kenneth James

- Last updated: September 29, 2023

- By Kenneth James

In a market full of competing money transfer services, Placid Express is not a particularly popular name. However, it is well-regarded by many for its fast transfers, good coverage, and fixed rates.

In this review, we will take a detailed look at Placid Express and everything it has to offer. We will go through the platform’s features and the pros in cons it offers. We will also answer some of the most common questions people have regarding this money transfer service. If you are wondering if Placid Express is the right platform for your needs, read on and you will find out.

Placid Express is a money transfer service established in 1996. It allows you to quickly send money to more than 25 Asian and European countries, including India. It supports a variety of payment methods and delivery options, including cash pickups. Placid Express is also a fully regulated platform that is safe and dependable to use. The platform enjoys overwhelmingly positive reviews and also has a mobile app that allows you to send money while on the go.

One of the major downsides of Placid Express is the high fees, especially for some country combinations. Even though exchange rates are competitive as a whole, there are many competing platforms that offer much better conditions. We highly recommend you use the fees and rates calculator on the Placid Express website to see what the platform offers for the country combination you are interested in.

Placid Express Fees & Exchange Rates

Fees at Placid Express depend on the country combination, payment method, delivery option, and transfer amount. Given the fact that there are so many factors involved, it is not easy to predict the exact costs of each transfer. We recommend you check the applicable taxes on the Placid Express website before making a transaction.

As a general rule, funding your transfer via a bank account results in the lowest fees. However, if you choose a credit card as a payment method, the fee will go up substantially. On top of that, different payment methods also affect the exchange rate for your transaction, which might result in additional charges.

When it comes to currency exchange at Placid Express, the platform operates at competitive exchange rates. They depend on the country combination and payment method for the specific transaction but are generally favorable. We should mention that transfers to India come with one of the best exchange rates on the market, which makes Placid Express preferred by many for this exact type of transaction. However, for many other currency combinations, there are better options out there.

Before making your transfer with Placid Express, we advise you to check the current exchange rates on the platform’s website. If the exchange rate for your transaction changes before you finalize the setup, you will get a notification.

Transfers funded with a debit or credit card can be available to the beneficiary within an hour, transfers funded from a bank account can be available within one to three business days:

1. Fastest Transfer Option – Delivery in about 1 hour

For the fastest money transfer option, you must pay with a debit card or credit card.

2. Slower Transfer Option – up to 1 – 3 business days

Placid Express money transfers funded with a bank account will be available within 1 – 3 business days.

Placid Express is a fully regulated service that is authorized by the US Department of Treasury. The platform is licensed to operate in all countries it supports, including the USA, Canada, Malaysia, and the European Union. Placid Express follows all rules and industry regulations, protecting its customers with insurance policies and safety regulations.

When it comes to technology, Placid Express utilizes the latest in security protocols and practices. Each transaction is made through an encrypted connection and no personal or financial information is stored. When using Placid Express, you can be assured that your money and data are safe.

When it comes to online reviews from users, Placid Express does remarkably well. On the popular review website Trustpilot, Placid Express has an impressive rating of 4.0/5, based on more than 1500 reviews. Over 70% of users give the highest possible recommendation, highlighting the fast transfer speed and customer service. Let’s take a look at some of the positive and negative things people say about Placid Express.

- As we already mentioned, transfer speed at Placid Express is excellent and people consider it one of the platform’s best features

- Many people are happy with the exchange rates at Placid, especially when sending larger amounts of money

- Users think that Placid Express is the best option for sending money to India due to the relatively low fees and good exchange rate

- There are some users who complain that the customer service at Placid Express take too long to respond to issues

- According to several reviews, transactions between some country combinations take longer than desirable

- Some reviewers were annoyed by the identity verification needed to use Placid Express. However, the platform requires it for security reasons, just as most other money transfer service providers

Using Placid Express is a simple and straightforward process. In the lines below, we will outline the specific steps you need to take in order to execute a money transfer through the platform.

First, you need to create your account. You will have to provide your name, email, phone number, and country of residence.

Select a safe password and finish creating your account.

After getting the confirmation email, log in to complete the registration.

Provide the details of your recipient. Depending on the delivery method, you might have to submit bank accounts information or an agent location for a cash pickup.

Choose the amount you want to send and select a payment method.

Confirm the transaction and receive your tracking code. You can use the code to check the status of the transfer online.

Placid Express supports several different payment and delivery options, each with its own applicable fees, exchange rates, and delivery times. Also, depending on the country of the recipient, you might be limited in your choice of delivery methods.

You can fund your transfer with a direct bank transfer from your account. This method is the cheapest but takes the longest to clear (3-5 business days).

While it is the fastest option, credit cards also have the highest fees. Supported brands include Visa, MasterCard, and Discover.

While bank deposits take longer to complete, they have low fees and are quite convenient.

Placid Express has an extensive network of agent locations where you can pick up your money. All you need to do is present the tracking number of the order and a valid ID.

There are two ways to contact Placid Express customer support — by online chat and phone. Below is the direct contact information you can use to get in touch directly with Placid Express customer support staff:

For Placid Express customer phone support, call Toll-Free Phone: 1-877-889-7021

You can start an online chat with Placid Express customer support directly on their website

(although not always available).

Placid Express has have local offices and customer service contact phone numbers in the US, Canada, Italy and Malaysia.

If you want to send money while on the go, Placid Express offers a state-of-the-art mobile app. It has all functionality as the web platform and is available for both iOS and Android devices. The Placid Express mobile app enjoys stellar reviews — it has a rating of 4.8/5 on the Apple Store, based on more than 600 testimonials. On Google Play, the app has a rating of 4.7/5, based on more than 70 reviews.

Final Word

Placid Express is an excellent money transfer service that is great for executing quick money transfers with an option for cash pickup. The service covers more than 25 countries worldwide and is known for its safety and security. While the fees and exchange rates are not the most favorable out there, many people still rely on Placid Express for their money transfer needs.

How Safe is Placid Express?

Placid Express is a fully regulated money transfer service that is licensed in the USA, Canada, Italy, the European Union, Malaysia, and all other countries in which it operates. It strictly follows all rules and industry regulations, making sure your money is safe and secure. All transactions through Placid Express are protected by encrypted connections and even manual checks

Does Placid Require My ID for Verification?

In some cases, Placid Express will require you to verify your identity by providing a valid, government-issued identification document. You might have to submit an ID card, passport, or a driver’s license in order to pass the security check.

Does Placid Have a Mobile App?

Yes — the Placid Transfer mobile app is available for both iOS and Android devices. Both versions enjoy good customer reviews and offer the same functionality as the web-based platform.

How Do I Track My Placid Express Transfer?

As soon as you confirm your Placid Express transaction, you will get its unique tracking code. You can log on to the platform’s website and use the code to check on the status of your transfer. Additionally, if you are sending money for cash pickup, the recipient will have to present the tracking code in order to claim their money.

Can I Cancel My Transfer with Placid?

You can cancel your Placid Express transfer within 10 minutes of confirming it and receiving your transaction receipt. You can also try to cancel the transfer after that by contacting customer service directly. However, if the funds have already been completely transferred, there is nothing you can do about it.

Is Placid Money Transfer Safe?

Yes, Placid Express utilizes the latest encryption technologies in order to ensure the security of all transactions. The personal and financial information of you and your recipient will be kept safe in accordance with all applicable laws and regulations.

Methodology

Our team at Transferly is dedicated to finding the best deals for you to send money abroad. We research, analyze, and review money transfer providers big and small to help you find the best providers for your money transfers. With our real-time money transfer comparison engine we find the fastest and cheapest ways for you to send money online. We provide ratings based on several important criteria to our readers.