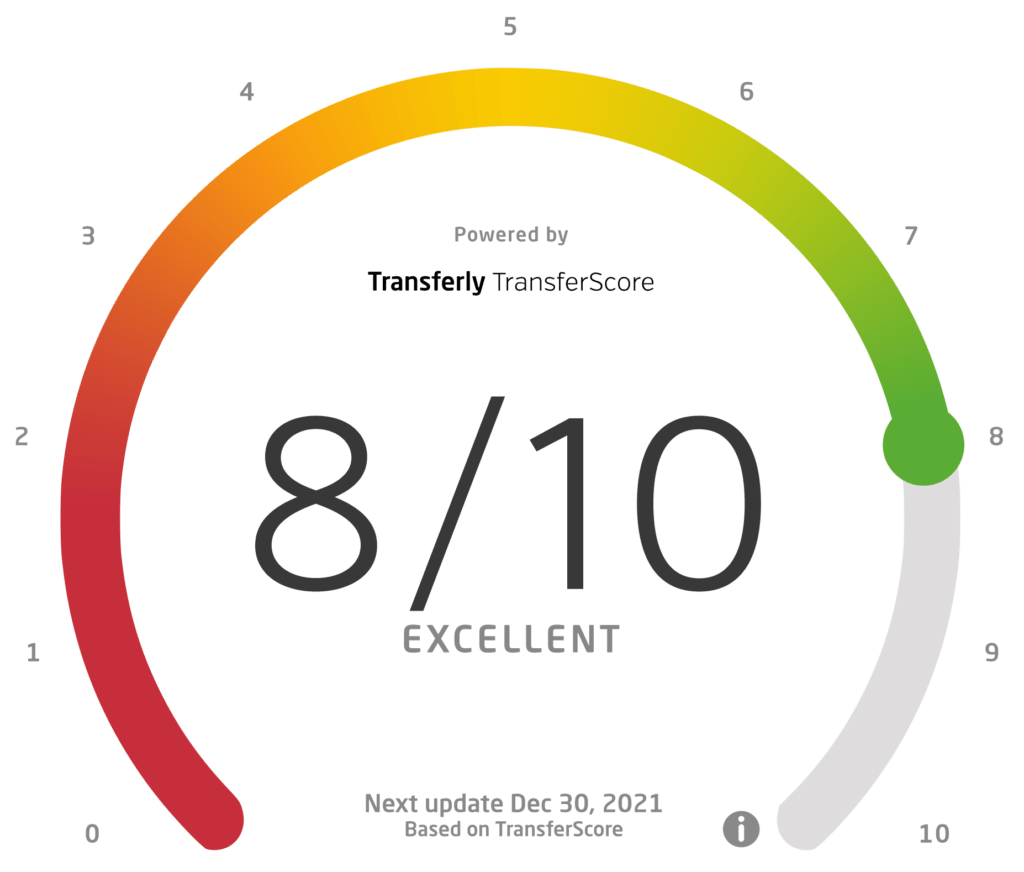

Transferly's Official Review of Remitly

Remitly Rating Breakdown

- Available to send money to 85 countries with over 190,000 locations

- Good option for inexperienced users – offers diligent & helpful customer support

ALL, AMD, ARS, AUD, AZN, BAM, BDT, BGN, BIF, BOB, BRL, BSD, BYN, CLP, CNY, COP, CRC, CZK, DOP, EGP, ETB, EUR, FJD, GBP, GEL, GHS, GMD, GNF, GTQ, GYD, HNL, HRK, HTG, HUF, IDR, ILS, INR, JMD, JOD, JPY, KES, KGS, KHR, KMF, KRW, KZT, LKR, LRD, MAD, MDL, MGA, MKD, MMK, MWK, MXN, MYR, NGN, NIO, NPR, PAB, PEN, PHP, PKR, PLN, PYG, RON, RSD, RUB, RWF, SLL, SRD, SVC, THB, TJS, TND, TRY, TZS, UAH, UGX, USD, UYU, UZS, VND, XAF, XOF, ZAR, ZMW

Pros

- 100% Satisfaction Guarantee Policy – One of the best features of Remitly is that if a transaction does not arrive on time, you will receive a full refund for all charges and fees.

- Variety of Delivery Options – With Remitly, you have multiple options for receiving money. Recipients can receive their money in their bank accounts, mobile wallets, or pick them up directly as cash at a local Remitly location.

- Vast Network of Countries – Remitly allows you to send money to over 85 countries. Additionally, there is a cash pickup option at more than 190,000 worldwide locations.

- Exceptional Transfer Speed – If you pay by credit card, your transaction will clear in a matter of minutes. On top of that, there are Express options for other payment methods, making Remitly one of the fastest money transfer services available.

- Referral Program – Remitly has an excellent referral program that allows you to claim rewards for inviting friends or family members to the platform.

Cons

- Lack of Hedging Features – Unfortunately, Remitly does not offer any hedging tools that can help you schedule and plan money transfers ahead of time.

- Relatively Low Transfer Limits – All new accounts at Remitly start with a daily cap of $2,999. In order to increase those limits, you need to contact Remitly to verify more personal information to increase your account.

- Exchange Rate Margins Are Inconsistent – Another con to Remitly is the fact that different exchange rate margins apply to different countries, which results in inconsistencies. On top of that, the speed of your transfers also affects the exchange rate margins for some transactions.

Kenneth James

- Last updated: November 7, 2023

- By Kenneth James

Remitly is one of the most popular money transfers services available. It is trusted by millions of users worldwide and is known for its intuitive interface and competitive rates. The platform has positive reviews on trusted websites and is commonly used in the industry. Remitly is an award-winning money transfer service that we can recommend as a safe method for international money transfers.

Before we get into the details, something significant to mention is Remitly’s 100% satisfaction guarantee policy. If your Remitly transaction does not arrive on time, the service will refund all charges and fees for the transfer back to you. This is a guarantee not all providers match and something that makes Remitly stand out.

Remitly is an online platform that provides international money transfer services. It allows users from the U.S., U.K., Australia, Canada, and the EU to execute cash transactions to more than 85 countries all around the world. We tested Remitly extensively and found the platform to be quite secure and with great transfer speed. Although the rates at which Remitly operates are fairly competitive, they are not always the cheapest. We always recommending checking our transfer comparison tool to find the lowest price.

David Boyd, Managing Director of Credit Card Compare, offers a distinctive perspective on the convenience and efficacy of using platforms like Remitly for international money transfers. He notes, “While Remitly provides a robust and secure option for international transfers, consumers must engage in comparative shopping before committing to a service. Platforms like ours at Credit Card Compare can aid users in navigating the complexities of rate comparisons to ensure they choose the most cost-effective solution.”

The platform and mobile app are available in multiple languages, including English, Spanish, French, German, Polish, Italian, Turkish, Romanian, and Vietnamese.

When it comes to supported payment methods, Remitly works with bank transfers and debit/credit cards. Depending on the location they are in, the recipient of a Remitly transfer can receive their money from several places:

- Bank to bank transfer, converted to their preferred currency

- Pickup from one of the 140,000 Remitly network locations

- In their mobile wallet on any smart device

- At an address of their choice, delivered by hand

Not unlike the majority of money transfer services out there, Remitly has daily and monthly limits when it comes to transfer amounts. Those depend on our “tier” on the platform. Your tier increases as you submit and verify more information about our account.

Remitly's Fees & Exchange Rates

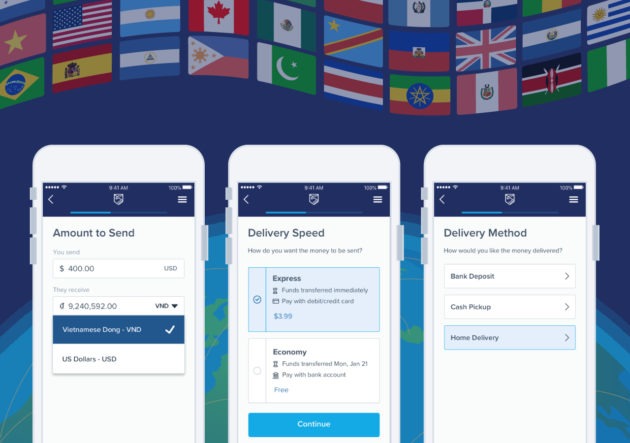

The Remitly transfer fee and exchange rate depend primarily on 4 factors. Let’s take a look at what they are below:

The total amount of money you send

The country you are sending to

The payment method of choice

The selected speed of transfer (Express or Economy)

To provide an example of Remitly’s transfer rate, let’s take a look at the fees you have to pay if you want to internationally send money to India with Remitly.

If you choose the Economy option, you pay no fee if you send a sum of $1000.00 or more. However, if you send less than that amount, you have to pay a fee of $3.99. With an Economy transaction, your money will arrive in India in 3 to 5 business days.

With the Express option, you receive the same fee if you want to send less than $1000.00 and no charge whatsoever for more than that amount. However, the transfer speed will go up significantly — the transaction will clear in up to 4 hours.

With the Remitly money transfer to India, the other difference between Express and Economy is that you can pay with a debit card for the former.

Countries & Currencies Remitly Accepts

Remitly allows you to send money internationally from and to a significant number of countries. Below, we will outline the full lists of countries supported by this Remitly’s money transfer platform.

With Remitly, you can send money abroad from Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Spain, Sweden, the UK, and the USA.

You can send money abroad to the following destination countries: Argentina, Bangladesh, Bolivia, Brazil, Bulgaria, Chile, Colombia, Costa Rica, Croatia, Czech Republic, Dominican Republic, Ecuador, Egypt, El Salvador, Ethiopia, Ghana, Guatemala, Haiti, Honduras, Hungary, India, Indonesia, Jamaica, Kenya, Malaysia, Mexico, Morocco, Nepal, Nicaragua, Nigeria, Pakistan, Panama, Paraguay, Peru, Philippines, Poland, Romania, Rwanda, Senegal, South Africa, Sri Lanka, Thailand, Tunisia, Turkey, Uganda, Uruguay, and Vietnam.

Sending money to the Philippines with Remitly is very common. If you need to set up a Remitly money transfer to the Philippines visit this link.

Mexico is another common location to set up a money transfer with Remitly. If you need to set up a Remitly money transfer to Mexico click here.

Types of Money Transfers at Remitly

Depending on the country you are sending from, there are a variety of destination delivery methods you can select. Remitly commonly offers 4 options to receive money:

You can choose to transfer money directly to the recipient’s bank account.

You can send to a mobile wallet owned by the recipient.

You can send the money to one of Remitly’s cash pickup locations. The only thing you need to keep in mind with this option is that the recipient must carry a valid ID that matches the name you have entered for the transfer.

Delivered by hand to your address.

How long does it take for Remitly to send money abroad?

Remitly has two options you can select when sending money. Depending on how quickly you need the money to arrive you can choose from the two options that meet your requirements:

1. Express Transfer – Delivery within an hour

The aforementioned Express transfer option can move our money for as little as 10 minutes. However, the exchange rates will be slightly worse, and you might end up paying extra fees if you are using a credit card. Still, for the amount of convenience and speed the Express option offers, some users are happy to pay the additional fee..

2. Economy Transfer – up to 5 business days

The Economy option has a standard delivery time of up to 5 business days. If you are not in a hurry, you should definitely go with that option. Sure, it will take more time, but you will not be charged extra fees and you will have better exchange rates.

What You Need to Know About Remilty’s Exchange Rates

Remitly keeps its exchange rates competitive by locking them to the current global market value before each transaction. This way, the platform ensures that you will not happen to send less or more than the intended amount. The Remitly exchange rate is clearly displayed for any transaction while you are preparing it, providing us with total transparency and honesty.

Accepted Payment Methods

With Remitly, you can send money overseas to a bank account or a mobile wallet. Additionally, you can make the money available for cash pickup at one of the authorized Remitly centers all over the world. It is important to point out that the platform only allows for one-time transfers. There are no hedging or scheduling options, which can be an issue for some users.

When it comes to accepted payment methods, you can either use a bank account or a credit/debit card. With bank transfers, transactions can take from 3 to 5 days, depending on the bank’s working hours. Transfers from credit or debit cards clear almost instantly, however you must pay an additional 3% fee to your credit card company if you use the former option.

There are three ways to reach Remitly’s customer support — by email, phone, and online chat. Please see three contact options below:

for Remitly customer service number, call Toll-Free Phone: +1 1-888-736-4859

you can email Remitly customer support directly at [email protected]

you can chat with a Remitly customer support staff member on their online chat feature here.

According to review website Trustpilot, Remitly reviews have an Excellent average rating of 4.5, based on more than 30,000 reviews. More than 84% of Remitly money transfer reviews give the service 5 out of 5 stars. Only around 7% of reviewers rate Remitly with a one-star Bad rating. Let’s take a look at some examples of both positive and negative feedback for Remitly.

In this section, we will take a closer look at what Remitly users consider the main pros and cons that Remitly offers as a money transfer service. Before that, we must mention that the team at Remitly takes the time to respond to the majority of negative reviews on Trustpilot. They do their best to resolve any issues and even offer refunds on the spot, if necessary.

- Money transfers are fast and inexpensive

- The platform is intuitive and easy to use

- The service is safe, reliable, and trustworthy

- Remitly offers exceptional customer service and support

- A small number of users had issues when canceling a transaction and waiting for a refund

- Sometimes transactions take a bit longer to clear, usually because of working hours in the country where the recipient resides

- A few users took issue with the personal identification and verification procedures at the platform. We need to point out that Remitly is required to collect such data by law and is not done frivolously.

Is Remitly safe to send money abroad? Transferly recommends Remitly as a safe, secure, and trustworthy money transfer service. The platform is registered as a Money Services Business with the U.S. Department of the Treasury, while also holding a license as a money transmitter in the States. Remitly also has full authorization to operate in the EU, including the UK and Ireland. It is also authorized for Canada and all its provinces.

Let’s take a look at some of the security measures Remitly takes in order to protect its users.

Account verification

The account verification process at Remitly is quite thorough. This way, the service limits how fake accounts and passwords can make their way onto the platform.

Identification

In order to transfer money via Remitly, users need to submit a valid identification document.

Constant screening

Suspicious activity and accounts are detected through both automated and manual checks.

Encryption

Transactions at Remitly are protected by a state-of-the-art, 256-bit SSL encryption

100% satisfaction guarantee

The 100% satisfaction guarantee Remitly offers lets us get a full refund if there is an issue or you cancel it. The same goes if the transaction has already cleared, but you are not satisfied with the quality of service.

As all other money transfer services, Remitly also has limits on how much you can send per transaction. The difference here is that the more personal information you provide and verify, the more your limits increase. The system consists of three fixed tiers and a custom option, which allows you to reach increased transfer limits.

With the Custom Tier option, you have the opportunity to speak with a Remitly representative and discuss your specific transfer needs when it comes to transfer limits.

So how does Remitly work? Remitly is very easy to use. For new customers, there is a simple 5 step process to start your first money transfer:

Create a free account with a valid email address and the required personal information.

Choose the country you are sending from and enter the amount of money for the transaction.

Enter the recipient’s name and contact information. If you are sending to a bank account, you will have to enter the banking details as well.

Pick a payment method. You get to choose from your bank account or a credit/debit card.

Confirm the transfer!

Its that simple. Remitly allows you to track your payment status in the app or online. Remitly will send messages to your mobile phone with updates on the status of the transaction.

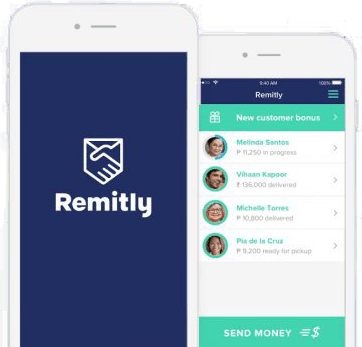

If you need to be able to send money overseas while on the go, the Remitly has a mobile app to deliver. It features all functionality as the desktop version and is available for Android and iOS devices. The app enjoys great reviews on Apple’s App Store (4.8/5 from 165,400 ratings) and Google’s Play Store (4.6/5 from 26,614 ratings). For instance, you can:

Users will be able to quickly and easily track their money transfer for delivery with exact time-stamps.

The Remitly app allows you to log in using biometrics, such as fingerprint or face recognition.

When using the Remitly mobile app, you can pay for money transfers using your bank account, credit card, or debit card.

Final Word

To sum it all up, Remitly is one of the better remittance money transfer services available. Their combination of incredible transfer speed, low fees, and fair exchange rates is the reason they have a strong user base.

However, if you’re looking for the absolute cheapest money transfer rates, they will sometimes have higher fees. So we always recommend you compare options.

Frequently Asked Questions (FAQs)

Unfortunately, there is no way to completely avoid paying fees when sending money through Remitly. However, you can minimize them by using a different payment method or transaction type. We always recommend using our money transfer comparison tool to find the lowest money transfer prices.

Remitly is one of the safest and most secure money transfer services available. Each transaction is protected by a 256-bit SSL encryption and the service has a 100% money-back guarantee. Remitly is trusted by hundreds of thousands of customers from all over the world.

Yes, Remitly is a legitimate money transfer service that is regulated by all needed authorities. It is registered as a Money Services Business with America’s U.S. Department of the Treasury, and also holds a license as a money transmitter. Remitly is also authorized to operate in the EU, UK, and Canada.

Transfer speed at Remitly depends on the type of transaction we choose. Economy transfers usually take 3-5 days to complete. On the other hand, Express transactions usually clear within 4 hours.

You can send money via Remitly by using a bank account or a credit/debit card.

Fees at Remitly vary greatly, depending on the country combination, the amount of money you are sending, and the payment method you are using. Before any transaction, the platform clearly shows us what fees are applicable for the transfer.

Transfer fees at Remitly vary greatly depending on the country combination you are using, the amount of money you are sending, and the payment method. You can use Tranferly’s money transfer comparison tool to compare the fees at Remitly with the ones other money transfer providers offer to find the cheapest price.

Xoom is a great service if you want to make fast transfers and use a debit/credit card as a payment method. In almost all cases, however, Remitly offers lower fees and better exchange rates. On top of that, it has much greater coverage than Xoom as a whole.

Economy transfers take 3-5 days to clear. Express transfers, which need a debit/credit card, complete in up to 4 hours (usually it takes a couple of minutes).

Upon registration, transfers are limited to $2,999 per day. If you confirm our identity and source of funds, the limit increases to $10,000 per day. The maximum amount you can send is $30,000 in a month and $60,000 for a six-month period. You can also contact the Remitly Customer Care team and request custom limits for your account.

There are plenty of ways to receive money via Remitly. In addition to receiving them in your bank account or mobile wallet, you also have the option to pick them up in cash or have them delivered directly to our home.

You will need to provide your full name, contact information, and a valid ID. If you are using a bank account as a payment method, you must also provide our banking details. Of course, you need to also provide the contact information and banking details of the person you are sending to.

Making a money transfer through Remitly is a simple and straightforward process. However, you need some specific information and documentation in order to initiate a money transfer. After all, safety at Remitly comes first, so the platform spares no effort when it comes to security. Here is a list of what you need to send money with Remitly.

- You will need to enter your full name and contact information. If you are using your bank account as a payment method, you will also need to provide bank account and routing details as well.

- A valid, government-issued personal ID. Usually, they will require your passport or driver’s license.

- Of course, you will also need the recipient’s name and contact information. If you are sending money to a bank account, you will need to input the bank name, SWIFT code, and the recipient’s account number.

- Finally, you need to have a valid payment method selected on the platform. You can choose to pay via bank account, credit card, or debit card. You can also pay cash for in-person transfers at one of Remitly’s centers.

Remitly allows you to directly monitor and track our money transfers. In order to do that, you have to either log into your account or get in touch with the Remitly customer support team.

Once you log into Remitly, you will be able to access the Transfer History page. It displays the status of all current and past transactions you have made. If you choose to contact the Remitly customer care team, you will have to submit the details of your transfer through email, live chat, or on the phone. A representative will then give you an update on the status of our transfe

You can only cancel a Remitly transaction before the money reaches the recipient. The option is available both on the website and via the Remitly app. All you have to do is go to our Transfer History, find the transaction you want to cancel, and click the “Cancel Transfer” button. You must also provide a reason for the cancellation.

Remitly is a platform that adheres to all security standards and industry requirements. The service implements advanced safety protocols and security solutions to ensure the integrity of each transaction. Here are some of the measures Remitly takes when it comes to security:

- Automated and manual monitoring of all transactions

- Detection of suspicious account activity

- Each account must be manually verified based on personal documents

- All transfers are secured by a 256-bit SSL encryption

Each platform has its own benefits that make it appealing to different types of users. Western Union, for example, has an unprecedented coverage worldwide, including a huge network of banks and agent locations in numerous cities. Remitly, on the other hand, has generally lower fees and no exchange rate markup whatsoever.

Which platform is right for you depends on your specific needs. Before committing to a money transfer service, we recommend doing your research and looking into what each of the bigger platforms has to offer. After all, you need to find the best possible option for you when it comes to fees, exchange rates, and coverage.

Yes, Remitly is one of the best platforms to send money to the Philippines. You can make secure transactions to bank accounts and mobile wallets, as well as make use of the cash pickup and home delivery options. Each Remitly transaction is guaranteed to be safe since the platform adheres to all industry and security standards.

If you are sending less than $1,000 to India, Remitly will charge you a flat fee of $3.99 per transaction. However, if you are sending more, you will not have to pay any fees whatsoever. Keep in mind that the exchange rate is different for the Express and Economy transfer methods.

Remitly makes money by charging a fee for each transaction, as well as putting a markup on the exchange rates between currencies. Fees and exchange rate markups are different between country combinations, payment methods, and delivery options.

One of the ways to increase the initial limit Remitly imposes on money transfers is to provide your SSN or ITIN (Individual Taxpayer Identification Number). Additional verification will also lead to your limit increasing. We need to point out that your information is safe with Remitly, as the service is regulated by international institutions and governments alike.

Methodology

Our team at Transferly is dedicated to finding the best deals for you to send money abroad. We research, analyze, and review money transfer providers big and small to help you find the best providers for your money transfers. With our real-time money transfer comparison engine we find the fastest and cheapest ways for you to send money online. We provide ratings based on several important criteria to our readers.