The 5 Cheapest & Fastest Ways to Send Money to Europe

Which money transfer service is the best?

Author

Kenneth James

- Last updated: August 4, 2021

- By Kenneth James

Overview

Looking for a fast, safe, and cheap way to send money to Europe? There are plenty of options and international money transfer services, but how to distinguish the best from the overly priced and scammers? For this reason, we here at Transferly have done the research and are going to help you find the safest, fastest, and the cheapest ways to send money to Europe from the US.

Lets dive in! The process of sending money to Europe, or any other continent for that matter, is called an international money transfer, or the IMT. And yes, you can always use your bank to send money internationally, but this is not the most wallet-friendly option. The bank usually takes around 7% of the sum in the name of transfer fees and has unfavorable exchange rates.

Fortunately, some companies have created platforms and services so that you can send your funds cheaper and faster than you would through the bank. However, these services are not all the same — they can vary depending on the amount, your and recipient’s bank accounts, and the country you are sending to.

Therefore, we have analyzed several money transfer services to determine which is the best money transfer service for your needs.

So, here are the finalists:

These companies can transfer your money through bank accounts, have low or no fees, better exchange rates, and offer various payment and delivery options. Moreover, the whole process is usually completed within two days.

So, now we will share with you which one is the fastest, the cheapest, the best to send money to many European countries simultaneously, the most well known, and which one to choose if you are sending large amounts. Let’s learn how to send money internationally.

The 5 Best Ways to Send Money to Europe

Summary of International Money Transfer Services

Top Five Money Transfer Services to Consider When You Want to Send Money to Europe from the USA

You should definitely consider these international money transfer services when sending money to Europe:

- Wise: Best Exchange Rates and Cheapest Costs

- XE Money Transfers: Fee Free & Best for No Minimums

- MoneyGram: Best for Fast Delivery and In-person Transfers

- OFX: Best for Sending Large Amounts with Low Costs

- Xoom: Best Large Company (PayPal) and Fast Delivery

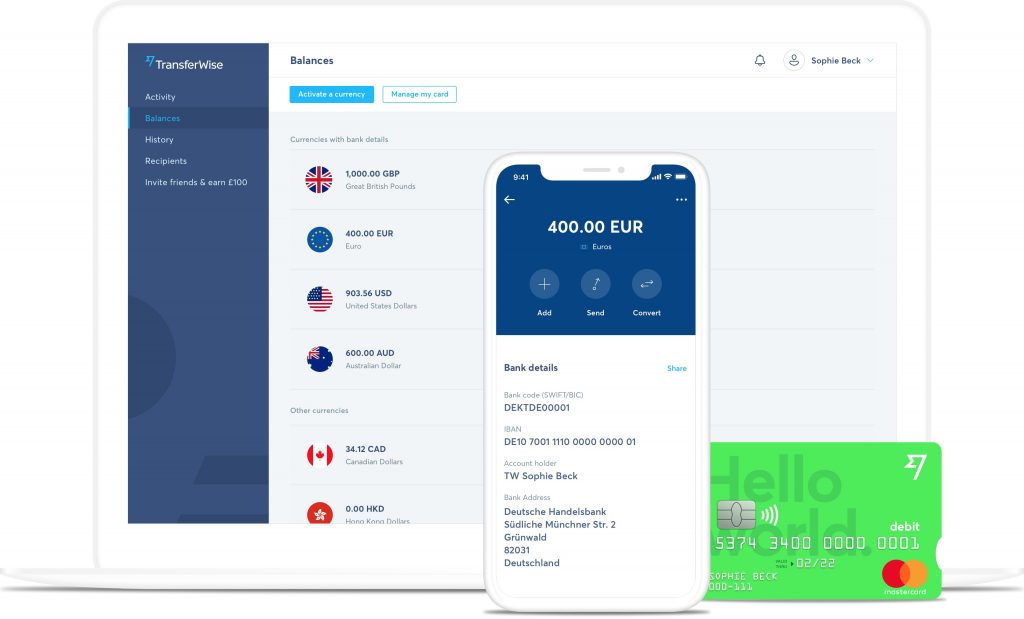

1. Wise (formerly known as TransferWise)

When you want to send money online on a budget, Wise is a great choice. Wise is an international money transfer service that offers the cheapest and easiest way to send funds from the US to Europe. Setting up your profile is incredibly easy, and downloading the Wise app to your phone makes things even more convenient. Additionally, Wise offers the best rates — the same as XE — without hidden fees and additional expenses.

Countries you can send money to from the US

You can send money to over 70 countries using Wise.

Cost to send money to Europe from the USA with Wise

Wise is one of the cheaper transfer companies. Its exchange rates are among the most favorable out there. Moreover, if you use your bank account, the fees are even lower — usually less than one percent of the amount you want to send. Wise also always provides the real and fair mid-market exchange rate so you know you’re getting a good deal. But if you’re going to send more than $10,000, OFX can sometimes be a better choice.

Transfer Fee: For the amount of up to $135,000, the fee is 0.45%. For any amount above $135,000, you have to pay a 0.35% fee. Additionally, there’s a flat fee of $1.07.

Exchange Rate: You will get the best exchange rate with Wise. Wise doesn’t use a margin.

Additional Fees: Bank debit is the most favorable, followed by bank wire transfer. It gets slightly more expensive if you use a debit card or credit card.

Additionally, you can calculate all fees and rates using a cost calculator found on Wise’s homepage.

How to send money with Wise

First, you need to create an account. When your account is all set up, the next step is to log in.

You should enter the amount and choose the country you want to send the money to make your transfer. Next, put in the recipient’s details and account number (which comes with a SWIFT number) to initiate the transfer. Then, make a US payment to Wise by a bank transfer, a credit, or debit card.

Speed: How long will it take to transfer money to Europe with Wise?

If you opt for bank transfers, it can take days for the process to complete, although it can be delivered the same day. When you want a quick transfer, use a credit or debit card. In that case, your cash will reach its destination within minutes. On the other hand, transferring money through your bank account typically takes up to three working days, depending on the recipient’s location.

Transfer Limits with Wise

If you are using a wire transfer, there’s a limit of $1 million per transfer. You can pay with your credit card, debit card, Apple Pay, or direct debit from the bank account. Furthermore, the recipient has to own a bank account.

Wise customer experience

You can reach Customer Support via phone only on weekdays. However, the Wise mobile app has high ratings, and you can easily find FAQs on the website.

Is it safe to send money with Wise?

Yes, it is safe. The US Financial Crimes Enforcement Network regulates Wise and its services. Their bank account is a part of Wells Fargo. Click here to read our full Wise review.

What we like about Wise

- Setting up an online profile is quick and easy

- The most favorable exchange rates and no hidden fees

- You can use a calculator to see the quote

- There’s a mobile app

For more details, contact Wise through their help page.

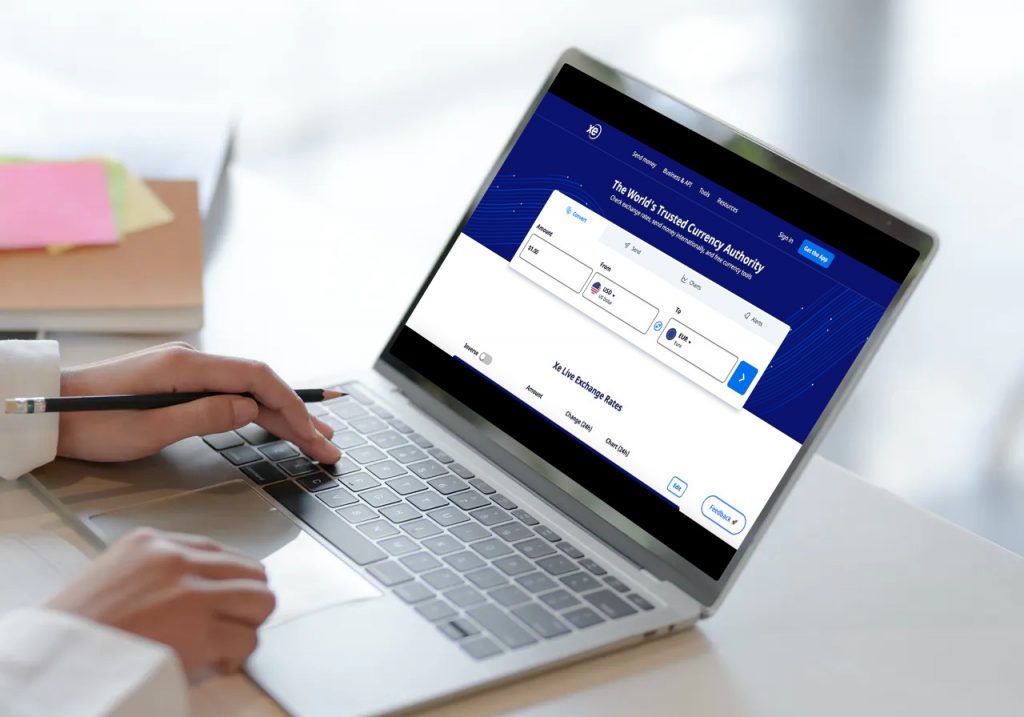

2. XE Money Transfers — No Minimum Amount

If you want a reputable and proven company for your money transfers, XE is the best option. XE Money Transfers is excellent for online customers who wish to send money abroad but are not pressured by a time limit. This company doesn’t have fixed fees and minimum amounts, hence you can send as much money as you want.

Countries you can send money to from the US

You can send cash to over 130 countries with XE Money Transfers.

Cost to send money to Europe from the USA with XE

XE Money Transfers is one of the cheaper services, but pay attention to the additional costs. This company will never charge transaction fees. Moreover, there aren’t any commissions or ongoing fees for the account you create. XE Money Transfers also offers great exchange rates, much lower than those you can get at an average bank.

That being said, the only payment method XE accepts is through a bank transfer. Therefore, if you want to pay with cash, debit, or credit cards, you should use a different platform. Furthermore, you can only send money to the recipient’s bank account. And since this is the only delivery method they support, you can’t request cash pick-ups, money transfers to digital wallets, or any other option.

Although XE Money Transfers offers competitive exchange rates, they are not the cheapest out there. This company puts a margin on top of actual rates — which strongly smells of hidden fees. So, if you opt for this platform, always check the applicable rates.

How to send money with XE

First, you’ll need to set up an online account. You can do this through your phone app as well. Then, after you log in, you’ll need to fill in the details such as the amount, the country, receiver’s info, and currency. In the end, you will need to send money to XE, and they will transfer it to the recipient’s bank account.

Speed: How long will it take to transfer money to Europe with XE?

The recipient will receive the money in their bank account in euro (EUR) currency within one to four business days.

How safe is it to transfer money with XE Money Transfers??

It is very safe. DFS in New York licensed XE as a Money Transmitter, and the company is registered with FINTRAC. Click here to read our full XE review.

What we like about XE Money Transfers

- There are no minimums you can transfer or fees

- It offers more favorable exchange rates for large sums

- This brand is proven and trustworthy

- There’s individual and business support, as well as excellent customer service

For more details, please get in touch with XE customer support.

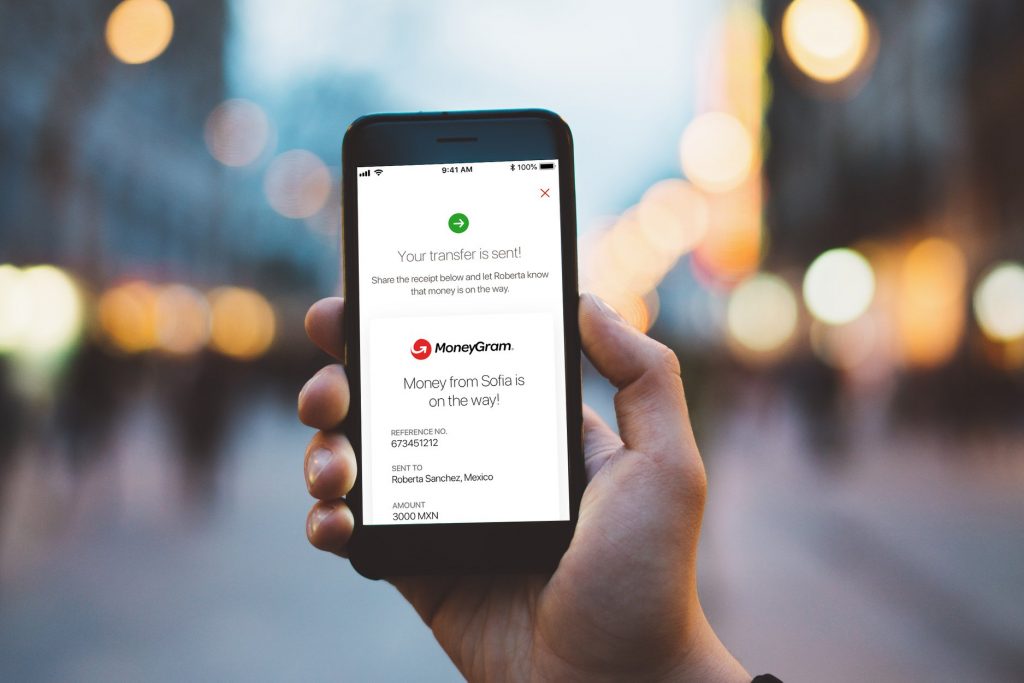

3. MoneyGram — When You Need Speed

MoneyGram is an international money transfer provider located in Dallas, Texas. The company was founded in 1940 and is the largest international payment platform, second only to Western Union. MoneyGram enables fund transfers between more than 200 countries, so it is the most commonly used by those wishing to send money to third-world countries. Furthermore, the company has a reputation of being the quickest — all online transfers take only a few hours to one business day to complete.

But if you find all of this appealing, you should probably know that MoneyGram accepts only MasterCard and Visa payments. Moreover, the transaction fees tend to change significantly, depending on the country. Another thing that will not make your wallet happy is that MoneyGram is not very transparent regarding its exchange fees. And more often than not, it tends to be more expensive than its competitors.

All in all, MoneyGram is the fastest way to send your cash, but it will also cost you more.

Countries you can send money to from the US

You can transfer your funds to more than 200 countries or about 347,000 locations.

Cost to send money to Europe from the USA with MoneyGram

The main issue with MoneyGram is that it is on the pricey side, and there are now cheaper ways to transfer money internationally. When it comes to the transfer fees, there’s no one-size-fits-all answer. If you are paying through your bank account, upfront fees won’t be too high. On the other hand, fees for other payment methods, including MoneyGram’s rate margins, are very high.

Other factors that will influence your fees include:

- The location you are sending money to

- The type of payment (in person, online, etc.)

- The number of funds you will transfer

- Whether the transfer will include two or more currencies

Luckily, the exchange rates for USD, EUR, and GBP are a bit more favorable.

How to send money with MoneyGram

MoneyGram works as a third-party intermediary between you and the recipient. It offers the following services:

- Sending money directly to a bank account

- Transferring funds to a digital wallet

- Sending money to prison inmates

To use these services, you need to create an online account and log in. Next, you should enter the information regarding an amount, country, and recipient’s details. Choose the payment method and send. You can pay MoneyGram with your debit card, credit card, or directly from your bank account.

Speed: How long will it take to transfer money to Europe with MoneyGram?

One of the benefits of using MoneyGram for international money transfers is that processing time is usually quick. In most cases, your money will reach the recipient in a matter of hours. However, it all depends on the payment method, banking hours, and some additional factors.

For example, in-person transfers take only 10 minutes. On the other hand, online payments take a few hours. Another great thing about MoneyGram is that you can track your transactions, which means you can easily estimate how long it will take your funds to reach the recipient.

Transfer Limits with MoneyGram

There’s a limit of $10,000 by payment and by month. But one of the benefits is that you can give cash, and your recipient can pick it up. On MoneyGram’s online platform, you can pay using your bank account, debit, or credit card.

MoneyGram customer experience

MoneyGram offers support via email and a live chat. Moreover, if you want to report fraud, you can make a phone call. You can easily find all the information about rates, fees, and transfer process online.

Is it safe to send money with MoneyGram?

MoneyGram is as safe and secure as it gets — it has a track record that spans over seven decades to prove it.

For additional information on MoneyGram, please find an email address here.

4. OFX — When You Want to Send Larger Sums

OFX is yet another older and proven money transfer company with a good track record for safety. This company operates globally and has physical offices in Sidney, London, as well as many other locations. Furthermore, OFX has personal account “dealers,” which is particularly useful when sending money for the first time. So, the combination of physical offices and personal managers for online services makes OFX a money transfer company with the best customer service.

OFX is ranked one of the top companies by users because it offers competitive exchange rates that become even better with larger sums. However, if you want to send a small amount, you might find this company to be a bit too expensive. Also, they work only with bank-to-bank transfers, which means there are no cash pick-ups.

Countries you can send money to from the US

OFX covers over 80 countries.

Cost to send money to Europe from the USA with OFX

OFX is yet another cheap international money transfer platform. They do not charge transfer fees, no matter the amount of cash you are trying to send. Moreover, exchange rate markups are less than 1%, which means you get excellent rates. Another great thing about OFX is that the percentage fees actually become lower as the amount increases.

Still, there are four fees to keep in mind when sending funds with OFX:

- Fees that your bank charges

- Exchange rates typically include a margin fee

- There’s a fixed fee or percentage

- Fees that a receiving bank charges

OFX does everything it can to reduce bank fees that can occasionally be pretty high. For that reason, they have a network of 115 local banks that won’t charge any fees to the sender or receiver.

Transfer Fee: The company doesn’t have a transfer fee for its customers in the US.

Exchange Rate: This company adds a margin to its exchange rate when converting US dollars to Euros (EUR).

Minimum Amount: There’s a $150 minimum for a single transfer and a $250 minimum for recurring payments.

OFX has a currency calculator that you can use to estimate the exchange fees on its web page. However, it only shows the interbank rate. So, if you use this calculator, please keep in mind that you will get a rate that doesn’t include OFX’s margin. If you want the precise estimation, you’ll need to create an account first.

How to send money with OFX

You should start by registering online for free. The process is fairly simple, but you have CS managers, called “dealers,” to help you if needed. After confirming your account and logging in, you can get the correct cost for your money transfer. Next, you should enter the amount, currency, IBAN number, and recipient’s information.

To complete the transaction, you need to pay OFX by a bank or wire transfer. Business customers can also use direct debit. Furthermore, you can track your money by logging into your account and clicking on the “Deals & Orders” button. You can also set up alerts and get notifications when OFX receives your funds and when they reach the recipient.

Speed: How long will it take to transfer money to Europe with OFX?

OFX doesn’t have a same-day delivery option, so if the speed is what you’re after, this company might not be for you. For international money transfers, the speed is as good as any other bank-to-bank transfer. It usually takes one to two business days for OFX to receive your funds and another one to two days for the company to deliver them to the recipient. The exact time will depend on the country you are sending money to as well as the banks on either end.

That being said, you can speed things up a bit by wiring the money to OFX from your bank. In that case, the process will take only a day or two, but it will come with some additional fees.

Transfer Limits with OFX

OFX works great if you are trying to send more than $1000, which is the minimum amount. On the other hand, there’s no upper limit. But you can send funds only through bank accounts, which means there’s no cash pick-up option.

OFX customer experience

This company has been able to provide great online support with FAQs you can easily find as well as 24/7 phone support. Moreover, there are many offices you can visit in person across the US. The downside is that you must create an account to see accurate exchange rates. Also, the transfer process can be confusing, especially if you are not familiar with the foreign exchange market and its terminology.

Is it safe to send money with OFX?

In short, yes. OFX has been around since 1988 and has facilitated over $100 billion in transactions so far. Even more important is the fact that they keep your funds separate from their own operational money. So, if they ever go bankrupt, you will get your money back.

What we like about OFX

- It’s easy to register

- Competitive exchange rates and fixed rates for large sums

- Excellent customer support

- You can do everything on your phone using the OFX app

For additional information regarding OFX, please visit their website.

5. Xoom — Owned by PayPal

Xoom is an international money transfer platform powered by PayPal and regulated in the US. Most people have a PayPal account, but those are tailored towards domestic transfers. Xoom is tailored towards international transfers. This service is safe and fast and offers many ways to send funds, such as credit cards, debit cards, and bank accounts. Moreover, it offers cash pick-ups in certain European countries, like Germany, Austria, France, Ireland, Lithuania, Italy, Montenegro, Spain, and Portugal.

On the other hand, Xoom tends to be more expensive than other services and is not very transparent regarding its fees. Also, it only supports personal transfers.

Countries you can send money to from the US

Xoom allows you to send funds to over 130 countries.

Cost to send money to Europe from the USA with Xoom

Xoom is generally pricey for an online service. The company has low upfront fees, usually under $5 if you use your bank account. However, the exchange rate markups can go over $3, which is costly compared to other companies with less than 1% markups. Still, Xoom is cheaper than your regular international bank wire transfer.

The actual cost of the transfer will depend on the following factors:

- Preferred payment method

- The currency you choose

- The amount

- The payout method

Furthermore, there are three types of fees you should pay attention to:

- A transfer fee

- An exchange rate

- Bank fees

If you want to know how much money you’ll need to pay in fees, you can use the Xoom calculator.

Transfer Fee: Transfer fees depend on how you pay for the transfer. For example, for any amount under $1000, the fee is around $5, but if you’re sending more than $1000, there’s no transfer fee. However, if you transfer money to a bank account and fund it with a credit or debit card, you’ll pay $30.49 in fees.

Exchange Rate: A lot of customers probably miss this “hidden” fee, which is not small at all. Xoom adds around a 2% margin to its foreign exchange rate when converting USD into EUR.

How to send money with Xoom

First, you need to create an account on the Xoom website or the mobile app. If you already have a PayPal account, you can also use that to sign up. After confirming your account and logging in, you should choose the amount and country to which you want to send money. But the amount of money you can send depends on your location, payout method, and partner limits (local banks, cash pick-up points, etc.).

Next, you’ll need to fill out the recipient’s details and pick the payment method. You can also choose to pay with a PayPal account. Finally, your recipient will get the funds on their bank account, or they can take cash at an agent location.

Speed: How long will it take to transfer money to Europe with Xoom?

Most transactions will be completed within minutes, no matter the payment method. However, don’t be surprised if your international money transfer takes a few days. The amount of time will depend on the funding method, the payout method, the amount, the recipient’s country, banking hours, and time zones.

Usually, if you pay using your credit or debit card, the whole process is completed in a matter of minutes. On the other hand, bank-to-bank transfers often take three to five days. Either way, Xoom will notify you of any updates via text messages and emails.

Transfer Limits with Xoom

The limit for an individual transfer is $50,000.

Xoom customer experience

PayPal owns Xoom, which means that both the state and federal government agencies in the US regulate its services.

Is it safe to send money with Xoom?

Yes, Xoom is very safe. It is part of PayPal and is just as secure and confidential as its parent company. The regulations PayPal holds are impressive and issued by a range of US agencies and state governments. This all plays well into the idea that Xoom is a safe and secure money-transfer service. Click here to read our full Xoom review.

What we like about Xoom

- In several European countries, you get a cash pick-up option

- Safe and trustworthy

- You can get notifications and alerts regarding the status of the transfer

To learn more about Xoom, please visit the website.

Why you should not send money internationally through your bank

If you were wondering why sending money to Europe through your bank account is more expensive, here is an explanation. For international wire transfers, banks charge a fixed fee and offer the worst exchange rates. All in all, you will pay 5–8% more than you would using a specialized platform. But what do those 5–8 % include?

- Large upfront service fees — because banks have more expenses to cover

- Hidden fees — while many money transfer companies are transparent about exchange fees, banks usually include extra fees such as international transfer charges

- Poor exchange rates for USD to EUR transfers — US banks offer 25% worse exchange rate margins for smaller amounts and 5% and 10% worse margins for medium or large amounts

- Additional Fees — a fee if the money passes through intermediary or correspondent banks (correspondent bank fee, which is anywhere between $10 and $100); the recipient’s bank charges a fee for receiving money; etc.

Conclusion

Sending funds to Europe from the US can be challenging. First, you need to check if certain international money transfer services are available in specific countries. Next, you have to consider exchange rates, transfer fees, payment, and delivery methods. On top of that, you should bear in mind that some platforms are slower than others, so the cheapest is not always the best.

For this reason, we have tested and listed all the best money transfer companies. And we hope that you will find this information valuable and practical.

How can I make sure my money is safe when I transfer it to Europe?

The five companies we have listed above take safety very seriously. Therefore, they include extra steps to protect any sensitive data and personal details. Still, here are a couple of tips on how to keep your funds safe:

- Before you choose a money transfer platform, double-check the privacy policy

- Create a unique and strong password

Is there a money transfer company that doesn't charge fees?

Yes. XE money transfer company won’t charge you any transfer fees. However, you will pay an additional margin to the rate online, also known as the mid-market rate.

Can I use an app to send money to Europe?

Yes. Most of these companies have mobile apps that you can use to send funds.

Are there any amount limits I should be aware of?

Money limits will depend on the company you choose to send funds with. When it comes to minimum transfer amounts, XE and Wise don’t have limits. But OFX has a $150 minimum per individual transaction.

On the other hand, Wise has a top limit of $50,000 per personal transaction and $250,000 to $1,000,000 limits for business accounts, depending on the state. XE and OFX don’t have any maximum limits, while Xoom insists on a $50,000 limit over a 24h period.

What is the cheapest way to transfer funds from the US to Europe?

The first recommendation is to skip bank transfers, PayPal, or cash-based money transfer services because they are the most expensive options. Instead, try XE, Wise, OFX, or even MoneyGram. Furthermore, you can use cost calculators on their web pages to get precise estimations.

What is the fastest way to send money from the US to Europe?

The transfer speed will depend on many factors, such as payment method, the amount, and the country. However, the companies with proven quick money transfer services are Xoom and MoneyGram.